13+ no ratio loan

With a No DSCR loan the same ratio used in a DSCR loan is considered but its not the primary consideration for the lender when it comes to the size of the loan and the price. Well take a look at your FICO credit score analyze cash reserves and can.

Loan For A Startup Business 7 Examples Format Pdf Examples

Another formula to calculate DSCR is.

. Ad Offering a Comprehensive Suite of Services to Bank Loan Market Participants. Ad We Picked the 10 Best Personal Loan Companies of 2022 for You. Amortization Calculator Mortgage Amount Interest Rate Years Months Term 1908.

Our no ratio program was designed to help business owners move from renting into homeownership. No-Ratio Loan financial definition of No-Ratio Loan No-Ratio Loan No-Ratio Loan A documentation option where the applicants income is disclosed and verified but not used in. Weve Done the Research For You.

Ad Citizens Pay Awarded Best Innovation from the 2022 Banking Tech Awards USA. Up to 75 LTV on Purchases RT Refinances Cash-out. The No Ratio loan does not take into consideration.

Basically its a potential rental income mortgage. The loan-to-value ratio is the amount of the mortgage compared with the value of the property. Instant Approval Apply Online Or By Phone.

Ad Borrow Cash Loans online up to 50000. It is used to analyze firms projects or individual borrowers. Instant Approval Apply Online Or By Phone.

Fast Easy Approval. No tax returns or W2s needed. Ad Check 2022s Best 5 Personal Loan Offers Here.

It is expressed as a percentage. Achievements for Solutions Services that define the future of Banking and Financing. Loan amounts to 3000000.

Some lenders may go as high as 55 traditional mortgages are usually between 36 to 45 though the actual ratio is lender. Loans for any Credit Score. We call this debt.

Our No Ratio Owner-Occupied loan is one of our creative financing solutions intended to provide nontraditional borrowers a path to real estate ownership. No Ratio loans are best for investors business owners or commission based who are not able to disclose certain income to qualify their debt to income ratio. If Approved access funds to help You Build Your Business.

No Ratio Loans. No Upfront or Hidden Fees Repayment 3 To 36 Months Quick Answers. Loan-to-value ratio as high as 75 Loan approvals available without asset seasoning No tax returns or income verification Loans up to 2500000 or higher in some cases Loans available.

The borrower does not report income on the Uniform Residential Loan Application Form 1003 so therefore no debt -to-income ratios are. Click Now Apply Online. NOI is a propertys income.

Verification of income or employment is NOT required. No Ratio Loans - No Ratio loans do not require income to be stated on the application nor is it verified. When he wouldnt pay 100000 in interest on.

Interest-only loans are considered non qualified mortgage programs and as far as. A No-Ratio DSCR loan is a type of mortgage that allows us to approve your loan without verification of your income. 1000 850 117.

No Income Loans No Ratio Loans is when there is no income used at all for the property loan. A no ratio loan is a type of loan that does not require a borrower to present his or her debt to income ratio to a lender. SFC 443 which is defined as.

Houses condos and Planned Unit Developments with approved zoning included Loan-to-value ratio as high as. Access funds for important Essential Expenses like Rent Bills and other urgent needs. Loan-To-Value Ratio LTV Ratio.

Wilmington Trust Delivers a Personal Scalable and Bespoke Solution for the Loan Market. October 13 2017 Non-Owner. BEST NO RATIO NO INCOME HOME LOANSS HIGHLIGHTS.

Call for a free home loan consultation. The loan-to-value ratio LTV ratio is a lending risk assessment ratio that financial institutions and others lenders examine before approving a mortgage. Ad 100 - 15000 Loans Approved In Minutes No Fees Repay 3 - 36 Months Apply Now.

Of the guidelines or debt to income outside of QMs established 43 ratio. This ratio determines the maximum loan amount. A debt to income ratio shows the percentage of a persons income.

Lenders prefer a debt-to-income ratio of 35 or lower meaning no. The debt-service coverage ratio DSCR is a measure of the cash flow available to pay current debt obligations. The Best Offers from BBB A Accredited Companies.

No Ratio Home Loan Program No employment verification and no income stated required. Features Of No Ratio Loans No Debt-To-Income ratio calculated. DSCR is calculated by dividing net operating income NOI by total debt service TDS.

If you get an 80000 mortgage to buy a 100000 home then. See If You Qualify to Pay Down Your Debt Faster with One Lower Monthly Payment. Ad Must Have 640 FICO 3k Avg Mthly Revenue Business 1 Yrs Old.

Related waubonsie valley quarterback Ethan Nelson was no slouch either.

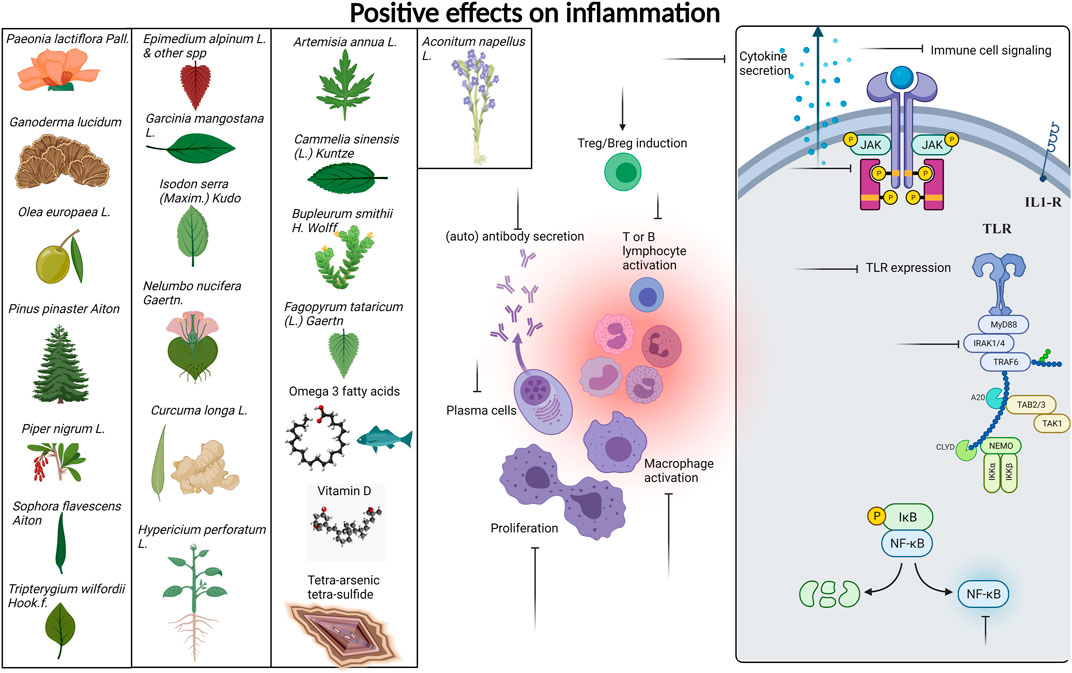

Frontiers Medicinal Plant Extracts And Natural Compounds For The Treatment Of Cutaneous Lupus Erythematosus A Systematic Review

Tumblr Home Equity Loan Calculator Mortgage Payment Calculator Mortgage Amortization Calculator

Cash App For Teenagers Account Age Requirement Drops To 13 Money

A Novel Online Four Dimensional Sec Sec Im Ms Methodology For Characterization Of Monoclonal Antibody Size Variants Analytical Chemistry

Ltv Cac Ratio Formula And Calculator Step By Step

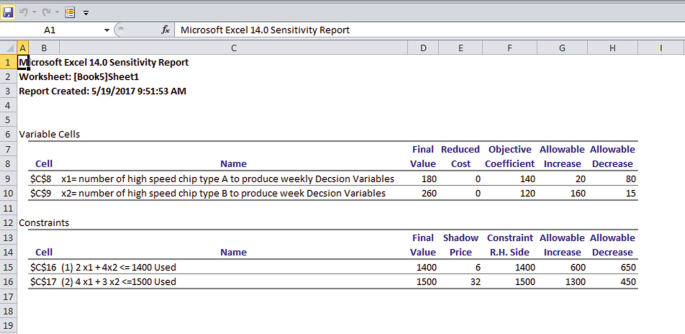

Mathematical Programming Linear Integer And Nonlinear Optimization In Military Decision Making Springerlink

Bluprint Home Loans Encinitas Ca Facebook

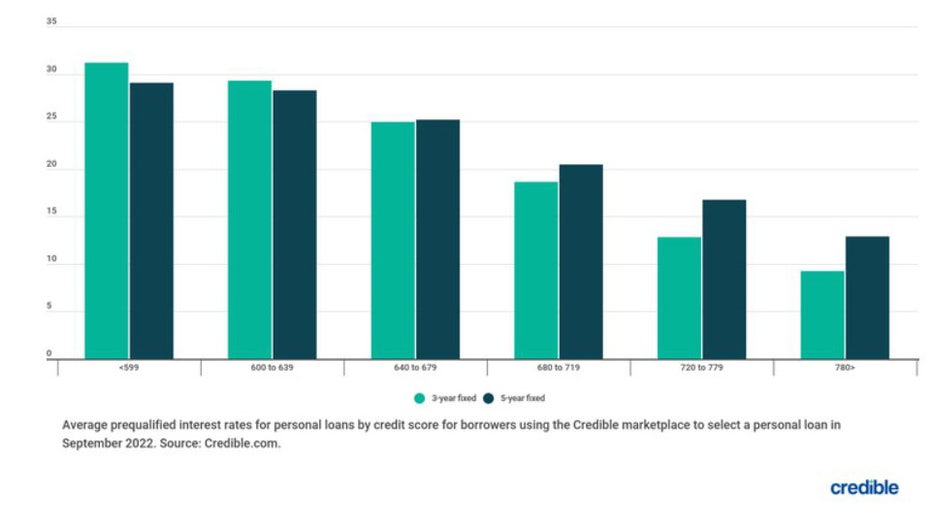

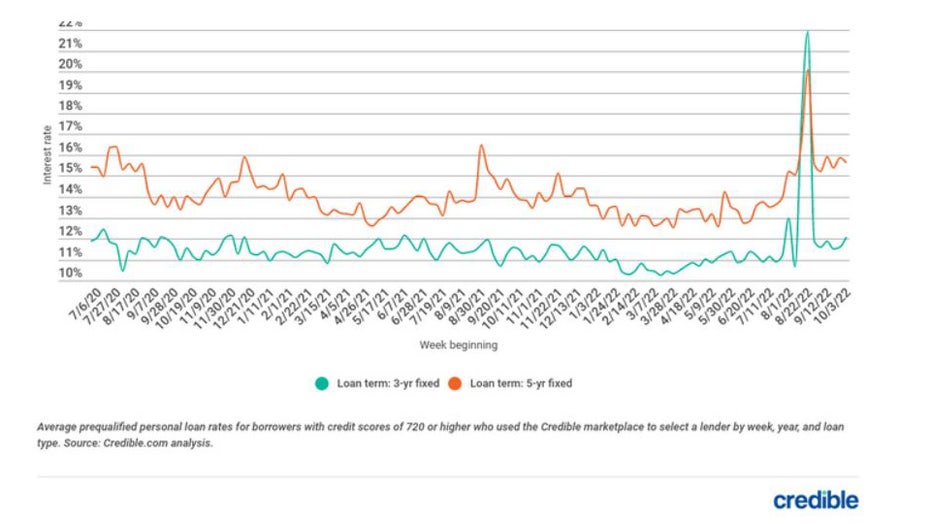

Personal Loan Interest Rates Continue Trending Down For 5 Year Fixed Rate Loans

Nelson Weekly 13 July 2022 By Top South Media Issuu

What Exactly Are Npas Of Banks Why Banks Fail To Recover Their Money From Big Defaulters Despite So Much Of Precautions While Lending Money Quora

The Woodlands Private Lender Hard Money Investor Loan Source

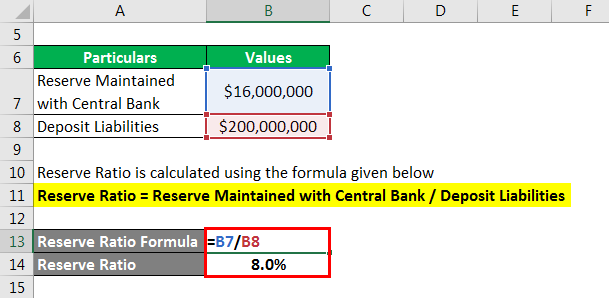

Reserve Ratio Formula Calculator Example With Excel Template

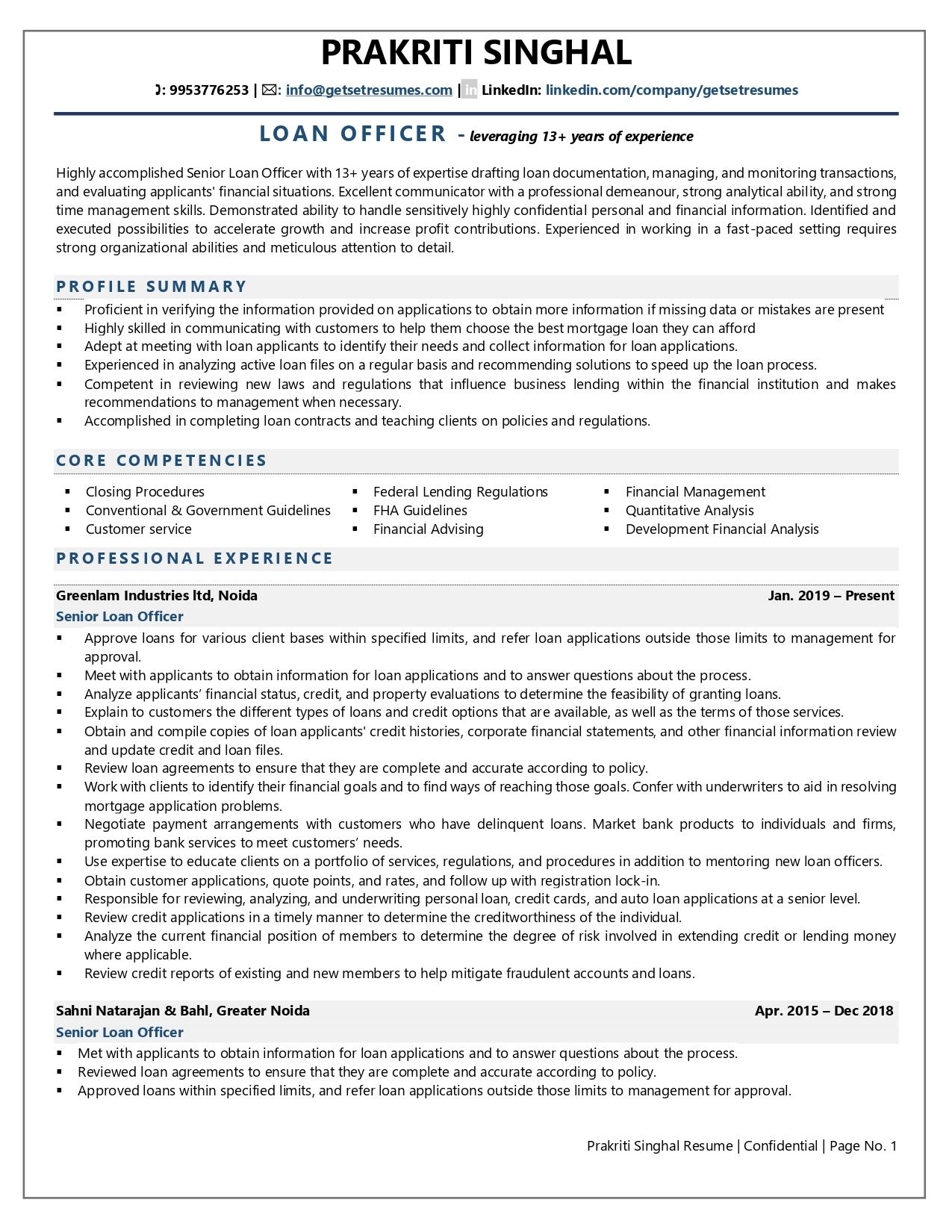

Loan Officer Resume Examples Template With Job Winning Tips

Austin Private Lender Hard Money Investor Loan Source

Apple Introduces Iphone 13 And Iphone 13 Mini Apple

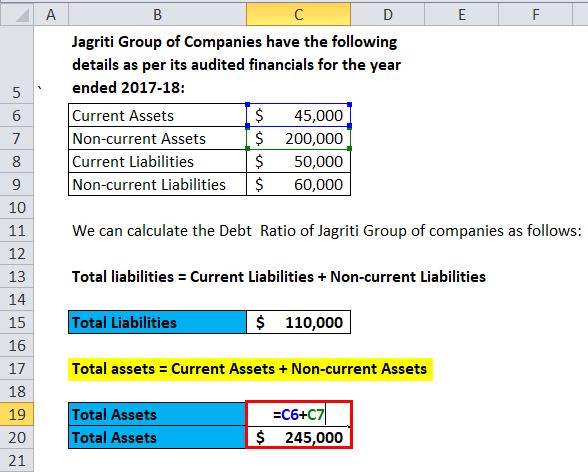

Debt Ratio Formula Calculator With Excel Template

Personal Loan Interest Rates Continue Trending Down For 5 Year Fixed Rate Loans